An Interest In:

Web News this Week

- March 29, 2024

- March 28, 2024

- March 27, 2024

- March 26, 2024

- March 25, 2024

- March 24, 2024

- March 23, 2024

September 24, 2013 03:30 pm GMT

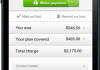

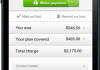

In 2009, Tomer Shoval went on vacation with his family to Mexico, which unfortunately ended on a sour note — and one with which many travelers can empathize — they all got sick. Back in the U.S. several months later, Shoval and his wife started receiving a series of invoices and summaries of benefits, which seemed to add insult to injury. The bills were expensive, the invoices were complex, and what their insurance covered and what it didn’t was confusing. Frustrated and beginning to get the sense that he wasn’t alone, Shoval quit his job eBay (where he was an executive) and co-founded Simplee with Roberto Rabinovich and Tom Tsarfati to help both patients and healthcare systems understand and manage healthcare expenses — from the comfort of their smartphones. Fast forward to 2013, Simplee is tracking and managing more than $3 billion in patient medical expenses and now processes “tens of millions” in patient payments each year, Shoval tells us. Since launching in 2011, the startup has raised $7.8 million from investors like Greylock IL, The Social+Capital Partnership and Embarcadero Ventures, and today, with adoption continuing, Simplee is announcing that it has adding $10 million in Series B financing, led by Heritage Group. Existing investors, Social+Capital and Greylock IL, also contributed to the round, bringing the startup’s total investment to just under $18 million. Shoval attributes the raise, and the startup’s growth over the last two years, in part, to the rise in consumer-driven healthcare in the U.S. People are increasingly choosing insurance coverage that comes with the pain of high deductibles, which means that patients have begun to pay of the cost of healthcare out of their own pockets. In fact, Shoval says that the average family in the U.S., on top of the cost of insurance, pays an additional $4,000 every year. Increasingly, patients are confused what exactly they’re paying for and why, while, on the other side, hospitals, practices and care providers have to deal with collecting a growing share of costs directly from these confused patients — rather than insurance companies. To help consumers deal with the hassle of confusing healthcare payments, Simplee launched a platform that combined the financial management tools of Mint.com with a mobile wallet to make the process easier to manage, to track visits, monitor benefits and pay their bills online. In addition to allowing users to track expenditures by each family

In 2009, Tomer Shoval went on vacation with his family to Mexico, which unfortunately ended on a sour note — and one with which many travelers can empathize — they all got sick. Back in the U.S. several months later, Shoval and his wife started receiving a series of invoices and summaries of benefits, which seemed to add insult to injury. The bills were expensive, the invoices were complex, and what their insurance covered and what it didn’t was confusing. Frustrated and beginning to get the sense that he wasn’t alone, Shoval quit his job eBay (where he was an executive) and co-founded Simplee with Roberto Rabinovich and Tom Tsarfati to help both patients and healthcare systems understand and manage healthcare expenses — from the comfort of their smartphones. Fast forward to 2013, Simplee is tracking and managing more than $3 billion in patient medical expenses and now processes “tens of millions” in patient payments each year, Shoval tells us. Since launching in 2011, the startup has raised $7.8 million from investors like Greylock IL, The Social+Capital Partnership and Embarcadero Ventures, and today, with adoption continuing, Simplee is announcing that it has adding $10 million in Series B financing, led by Heritage Group. Existing investors, Social+Capital and Greylock IL, also contributed to the round, bringing the startup’s total investment to just under $18 million. Shoval attributes the raise, and the startup’s growth over the last two years, in part, to the rise in consumer-driven healthcare in the U.S. People are increasingly choosing insurance coverage that comes with the pain of high deductibles, which means that patients have begun to pay of the cost of healthcare out of their own pockets. In fact, Shoval says that the average family in the U.S., on top of the cost of insurance, pays an additional $4,000 every year. Increasingly, patients are confused what exactly they’re paying for and why, while, on the other side, hospitals, practices and care providers have to deal with collecting a growing share of costs directly from these confused patients — rather than insurance companies. To help consumers deal with the hassle of confusing healthcare payments, Simplee launched a platform that combined the financial management tools of Mint.com with a mobile wallet to make the process easier to manage, to track visits, monitor benefits and pay their bills online. In addition to allowing users to track expenditures by each family

Original Link: http://feedproxy.google.com/~r/Techcrunch/~3/h0DBZlb1W5U/

With $3B Under Management, Simplee Lands $10M To Bring Medical Bill Payments Into The Smartphone Era

In 2009, Tomer Shoval went on vacation with his family to Mexico, which unfortunately ended on a sour note — and one with which many travelers can empathize — they all got sick. Back in the U.S. several months later, Shoval and his wife started receiving a series of invoices and summaries of benefits, which seemed to add insult to injury. The bills were expensive, the invoices were complex, and what their insurance covered and what it didn’t was confusing. Frustrated and beginning to get the sense that he wasn’t alone, Shoval quit his job eBay (where he was an executive) and co-founded Simplee with Roberto Rabinovich and Tom Tsarfati to help both patients and healthcare systems understand and manage healthcare expenses — from the comfort of their smartphones. Fast forward to 2013, Simplee is tracking and managing more than $3 billion in patient medical expenses and now processes “tens of millions” in patient payments each year, Shoval tells us. Since launching in 2011, the startup has raised $7.8 million from investors like Greylock IL, The Social+Capital Partnership and Embarcadero Ventures, and today, with adoption continuing, Simplee is announcing that it has adding $10 million in Series B financing, led by Heritage Group. Existing investors, Social+Capital and Greylock IL, also contributed to the round, bringing the startup’s total investment to just under $18 million. Shoval attributes the raise, and the startup’s growth over the last two years, in part, to the rise in consumer-driven healthcare in the U.S. People are increasingly choosing insurance coverage that comes with the pain of high deductibles, which means that patients have begun to pay of the cost of healthcare out of their own pockets. In fact, Shoval says that the average family in the U.S., on top of the cost of insurance, pays an additional $4,000 every year. Increasingly, patients are confused what exactly they’re paying for and why, while, on the other side, hospitals, practices and care providers have to deal with collecting a growing share of costs directly from these confused patients — rather than insurance companies. To help consumers deal with the hassle of confusing healthcare payments, Simplee launched a platform that combined the financial management tools of Mint.com with a mobile wallet to make the process easier to manage, to track visits, monitor benefits and pay their bills online. In addition to allowing users to track expenditures by each family

In 2009, Tomer Shoval went on vacation with his family to Mexico, which unfortunately ended on a sour note — and one with which many travelers can empathize — they all got sick. Back in the U.S. several months later, Shoval and his wife started receiving a series of invoices and summaries of benefits, which seemed to add insult to injury. The bills were expensive, the invoices were complex, and what their insurance covered and what it didn’t was confusing. Frustrated and beginning to get the sense that he wasn’t alone, Shoval quit his job eBay (where he was an executive) and co-founded Simplee with Roberto Rabinovich and Tom Tsarfati to help both patients and healthcare systems understand and manage healthcare expenses — from the comfort of their smartphones. Fast forward to 2013, Simplee is tracking and managing more than $3 billion in patient medical expenses and now processes “tens of millions” in patient payments each year, Shoval tells us. Since launching in 2011, the startup has raised $7.8 million from investors like Greylock IL, The Social+Capital Partnership and Embarcadero Ventures, and today, with adoption continuing, Simplee is announcing that it has adding $10 million in Series B financing, led by Heritage Group. Existing investors, Social+Capital and Greylock IL, also contributed to the round, bringing the startup’s total investment to just under $18 million. Shoval attributes the raise, and the startup’s growth over the last two years, in part, to the rise in consumer-driven healthcare in the U.S. People are increasingly choosing insurance coverage that comes with the pain of high deductibles, which means that patients have begun to pay of the cost of healthcare out of their own pockets. In fact, Shoval says that the average family in the U.S., on top of the cost of insurance, pays an additional $4,000 every year. Increasingly, patients are confused what exactly they’re paying for and why, while, on the other side, hospitals, practices and care providers have to deal with collecting a growing share of costs directly from these confused patients — rather than insurance companies. To help consumers deal with the hassle of confusing healthcare payments, Simplee launched a platform that combined the financial management tools of Mint.com with a mobile wallet to make the process easier to manage, to track visits, monitor benefits and pay their bills online. In addition to allowing users to track expenditures by each familyOriginal Link: http://feedproxy.google.com/~r/Techcrunch/~3/h0DBZlb1W5U/

Share this article:

Tweet

View Full Article

Techcrunch

TechCrunch is a leading technology blog, dedicated to obsessively profiling startups, reviewing new Internet products, and breaking tech news.

TechCrunch is a leading technology blog, dedicated to obsessively profiling startups, reviewing new Internet products, and breaking tech news.More About this Source Visit Techcrunch